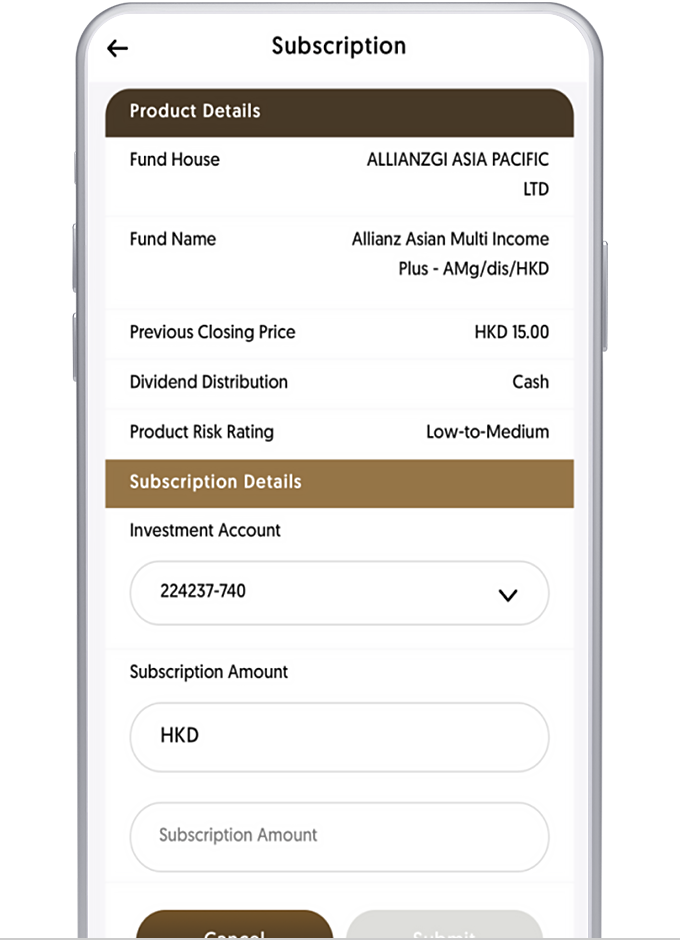

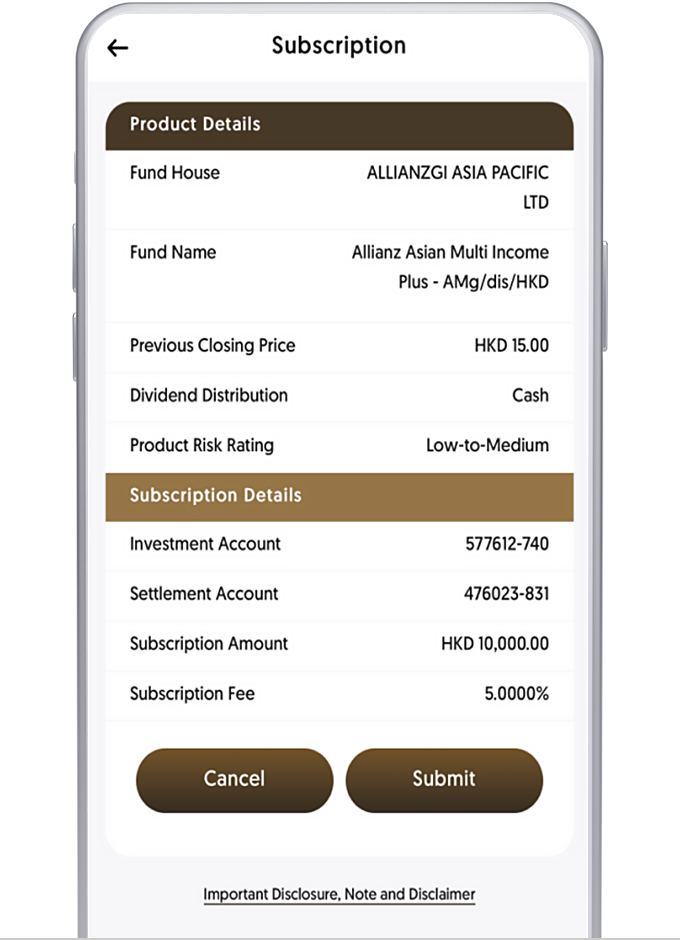

Investment involves risks and the price of investment products may fluctuate or even become worthless. Past record is not an indicator of future performance. Losses may be incurred rather than making a profit as a result of investment. Investment funds which invest in certain markets (e.g. Emerging Market) may involve a higher degree of investment risks.

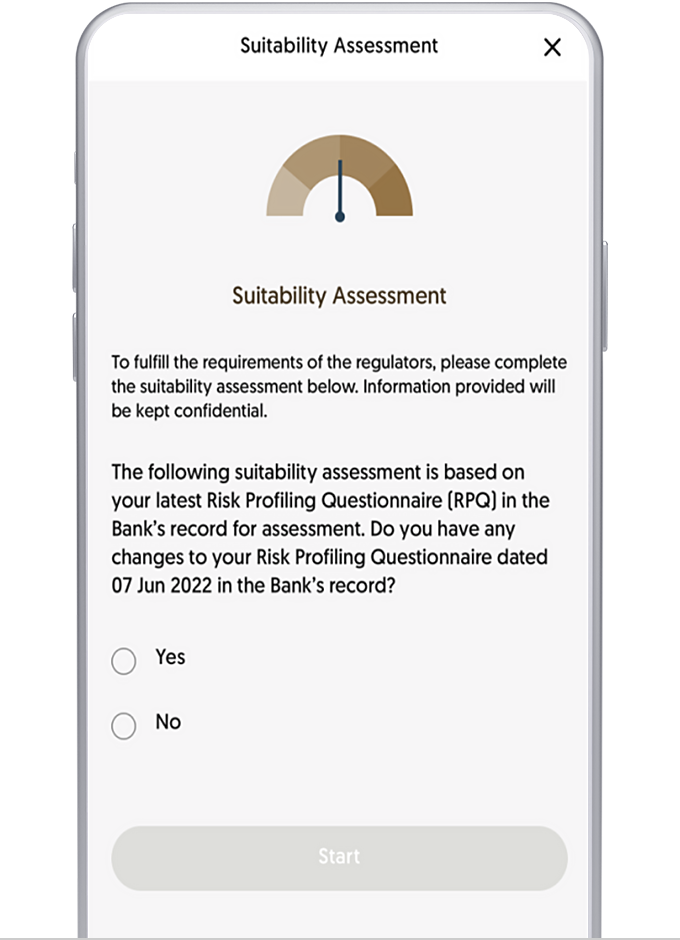

Certain investment funds may use financial derivative instruments to meet their investment objectives (please refer to respective offering document for detailed information), thus entailing higher volatility in net asset value. You should carefully and independently consider whether the investment products are suitable for you in light of your investment experience, objectives, financial position and risk profile.

The respective fund management company is the only person quoting prices and counterparty for the fund(s) under its management. You should therefore carefully consider the liquidity risk involved. Independent professional advice should be obtained if necessary. Please carefully read the relevant offering document (including but not limited to the risk factors stated therein) and terms and conditions before making any investment decisions.

The above mentioned investment products are neither protected by the Deposit Protection Scheme nor the Investor Compensation Fund in Hong Kong.

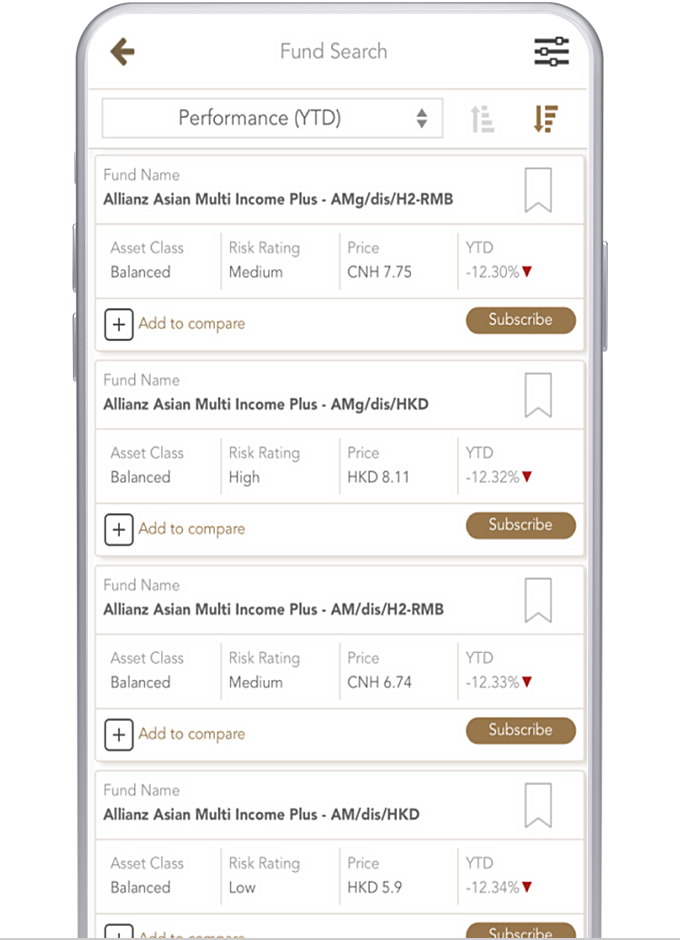

Please note that the unit price shown for each fund is based on its latest fund's NAV or its Bid price and is for reference only. The actual subscription price of each fund may be different to the reference offer price. All prices are subject to final confirmation by the Bank. Unit price information of each fund is shown in its denominated currency or reporting currency. Investment returns are denominated in the respective fund’s base currency (may be a foreign currency). You may be exposed to the risks of fluctuations in the exchange rate of USD / HKD / foreign currency.

The above mentioned investment fund(s) has been authorized by the Securities and Futures Commission in Hong Kong (the "SFC"). However, SFC authorization is not a recommendation or endorsement of an investment fund nor does it guarantee the commercial merits of an investment fund or its performance. It does not mean the investment fund is suitable for all investors nor is it an endorsement of its suitability for any particular investor or class of investors.

This material does not constitute any offer, invitation or recommendation to any person to enter into any transaction described therein or any similar transaction, nor does it constitute any prediction of likely future price movements. Investor should not make investment decisions based on this material alone.

If there is any discrepancy between the English and the Chinese versions hereof, the English version shall prevail.

The information on this webpage has not been reviewed by the SFC.