Business Loan Insurance

Safeguard your business against unexpected events

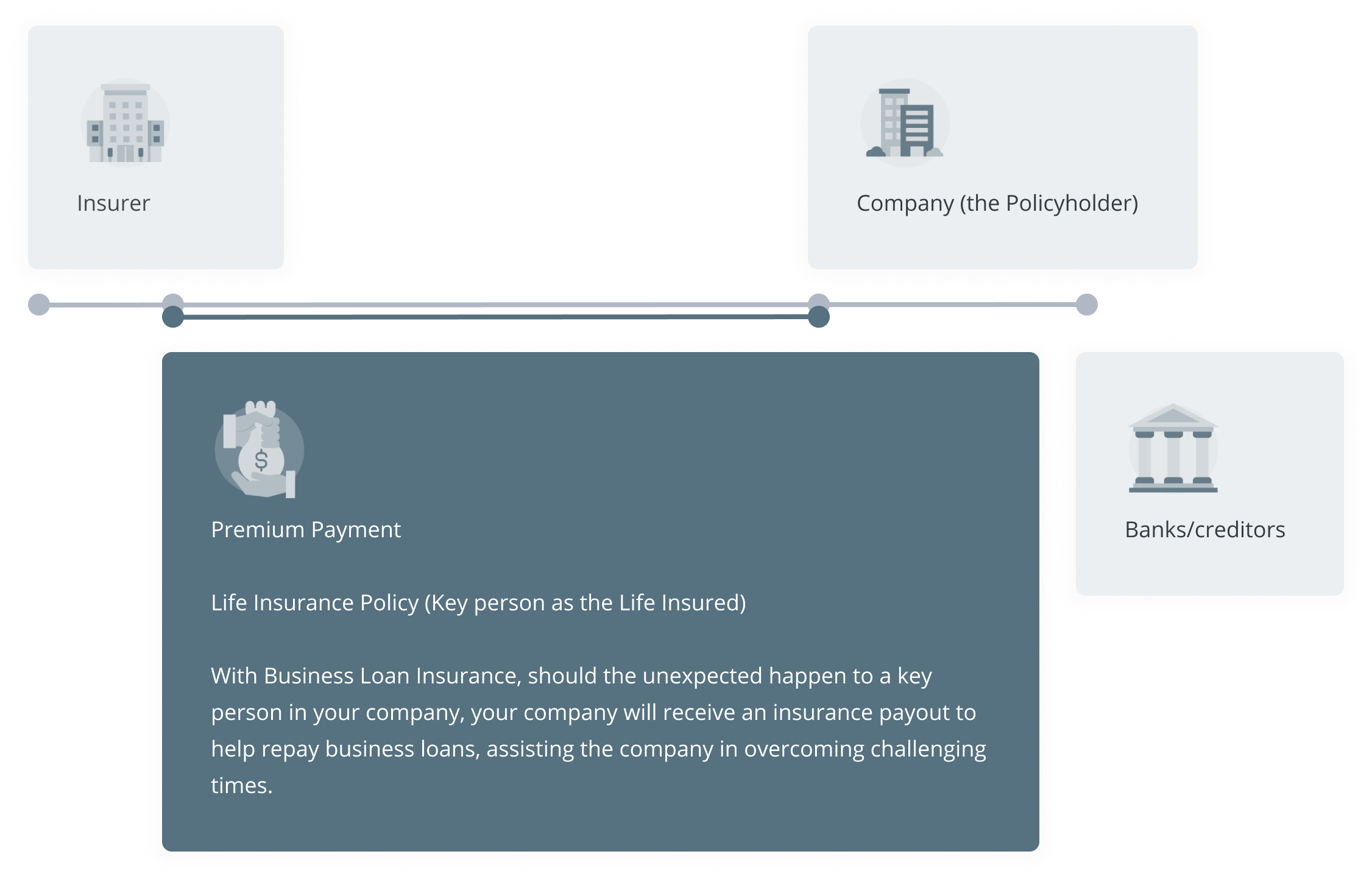

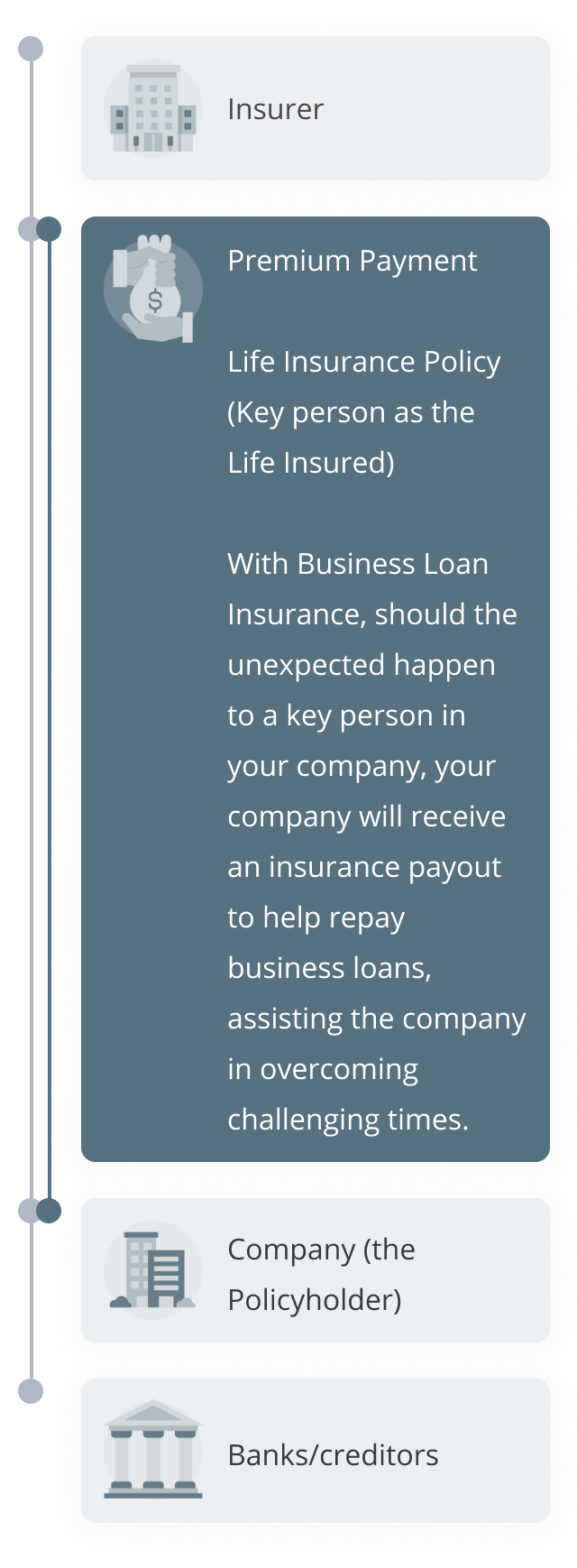

Loans can be the lifeline for business growth and cash flow. But what would happen should your company lose a key person? Protect your company from the unexpected with Business Loan Insurance, ensuring your business stays on track.

Our Business Loan Insurance ensures your company stays financially secure due to the death or critical illness of a key person in your company.

Benefits of Business Loan Insurance

Maintain business operations

With coverage against the unexpected, your company can maintain operations without interruption, even during challenging times.

With coverage against the unexpected, your company can maintain operations without interruption, even during challenging times.

Mitigate financial risks

Business Loan Insurance shields your company from unforeseen events that could disrupt loan repayments include the loss of key persons.

Business Loan Insurance shields your company from unforeseen events that could disrupt loan repayments include the loss of key persons.

Preserves creditworthiness

With coverage to ensure loan repayments, Business Loan Insurance prevents financial instability and protects your company’s creditworthiness.

With coverage to ensure loan repayments, Business Loan Insurance prevents financial instability and protects your company’s creditworthiness.