Keyman Insurance (or Key Person Insurance) is like a safety net for your company. It’s a life insurance policy for your key players — say, the owner or essential employees. The company pays the premiums and receives an insurance payout should the insured key persons be incapacitated due to death or critical illness. The payout can be used to help keep things running smoothly during tough times, reassuring your staff and customers about your company’s prospects.

KEYMAN INSURANCE

Don’t let setbacks sideline your success

Whether it’s the boss, an experienced manager or a star employee, your company’s key people are your valuable assets.

Key persons bring expertise, connections, and leadership to help your company succeed. However, if they are sidelined by death or a critical illness and become unable to work, your company will be negatively impacted. This is why every company needs keyman insurance.

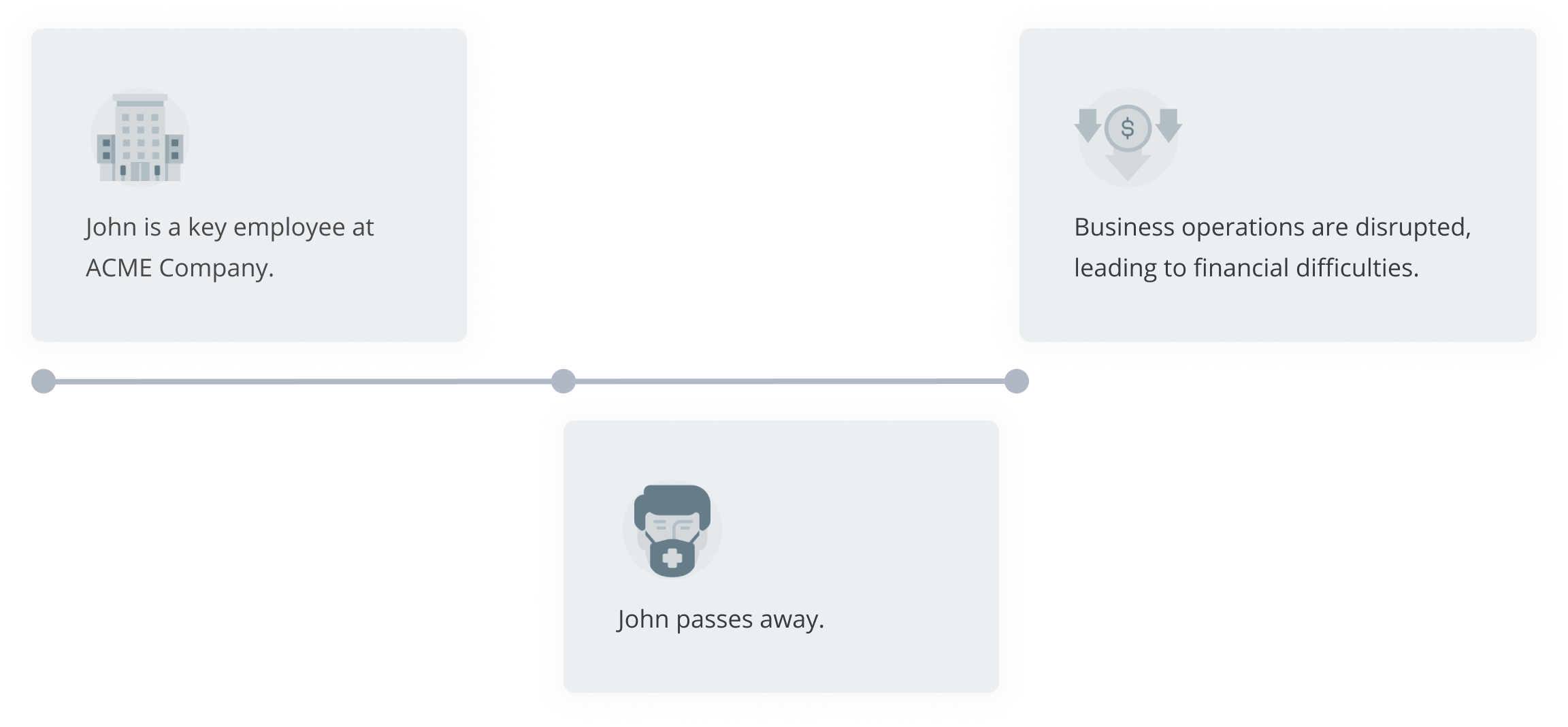

With his expertise and connections, John is key to ACME Company’s success. Should something happen to him, the business may take a substantial hit.

With his expertise and connections, John is key to ACME Company’s success. Should something happen to him, the business may take a substantial hit.

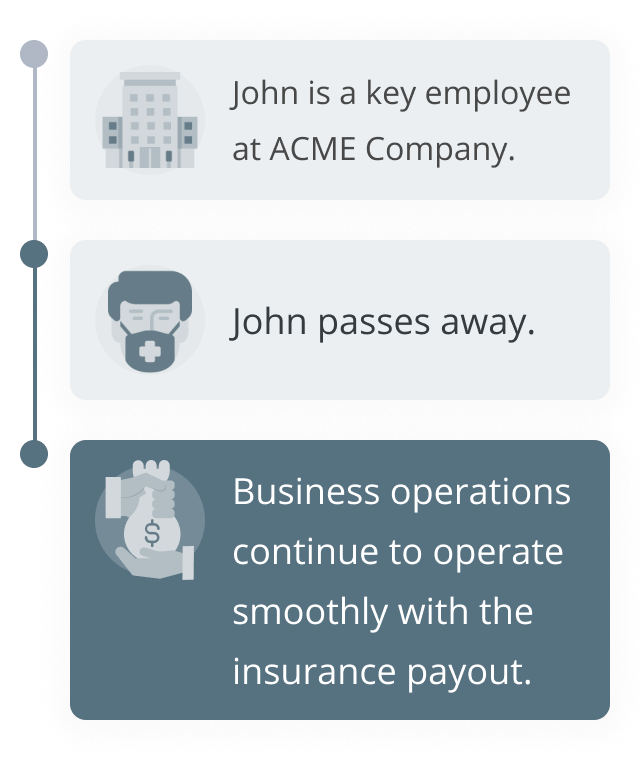

Should the unthinkable happen to John, ACME would receive an insurance payout to cover losses as well as to find and train a successor — helping the company overcome tough times.

Should the unthinkable happen to John, ACME would receive an insurance payout to cover losses as well as to find and train a successor — helping the company overcome tough times.

While we cannot prevent the unforeseen, we can help safeguard your company’s future with keyman insurance — protecting your business from the financial impacts of losing a key person due to death, illness or disability.

Covers revenue gaps

Receive a lump sum to offset business losses due to loss of key persons.

Receive a lump sum to offset business losses due to loss of key persons.

Hire and train a successor

Use the insurance payout to recruit and train a successor, keeping your operations on track.

Use the insurance payout to recruit and train a successor, keeping your operations on track.

Provide reassurance to stakeholders

Assure employees , customers and creditors that the business will continue unhindered.

Assure employees , customers and creditors that the business will continue unhindered.

Common questions

It cushions the financial blow and minimises disruptions in the unfortunate event that a key person in the company is suddenly no longer available. It covers costs like recruiting and training successors while keeping operations steady, protecting your company’s future prospects.

Any person whose skills, knowledge or connections are crucial to success can be considered a key person. Whether it’s the company founder, the CEO, a top salesperson or key manager, their loss could have a major impact on your company’s operations and profitability.

A company can have Keyman Insurance for as many key individuals as necessary. In fact, each policy is customised to match the person’s role and the financial impact their loss could have on the company.