Partnership Insurance helps ensure business continuity in the event of a partner’s death or incapacitation. It provides funds to buy out the partner’s shares, minimising disruption and financial strain on the other partners.

Partnership Protection

Safeguard your business against the loss of key partner

Business partners are key to a company’s success. But should a partner pass away or become incapacitated, how can you safeguard your business and ensure the partner’s shares are responsibly managed? This is where Partnership Insurance can help.

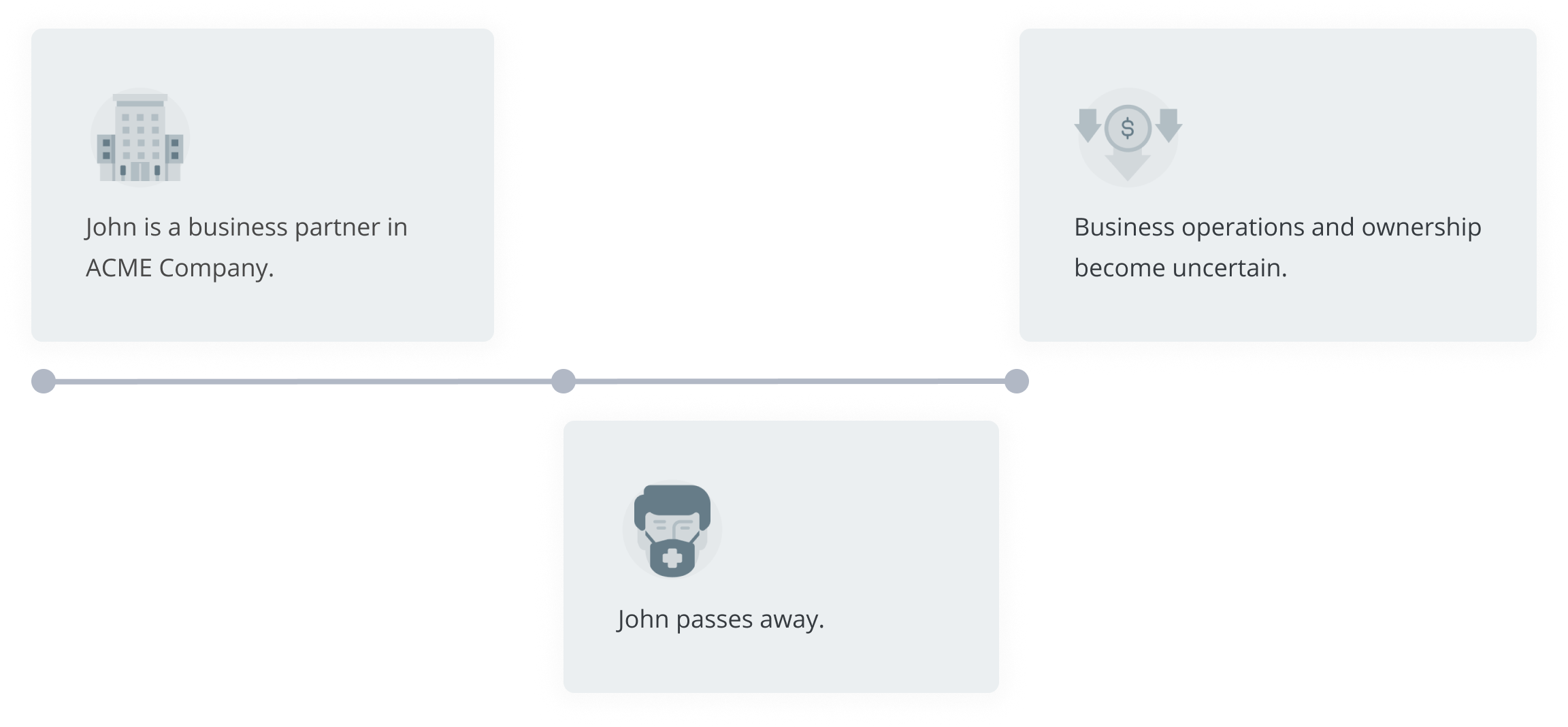

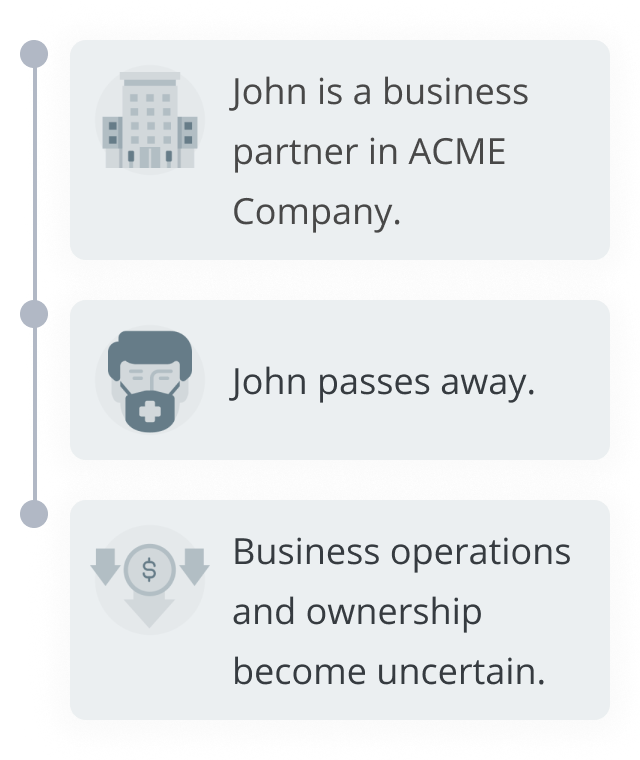

John is a business partner who holds 50% of ACME Company’s shares. Should something happen to him, business operations may be affected—and ownership of his shares becomes uncertain.

John is a business partner who holds 50% of ACME Company’s shares. Should something happen to him, business operations may be affected—and ownership of his shares becomes uncertain.

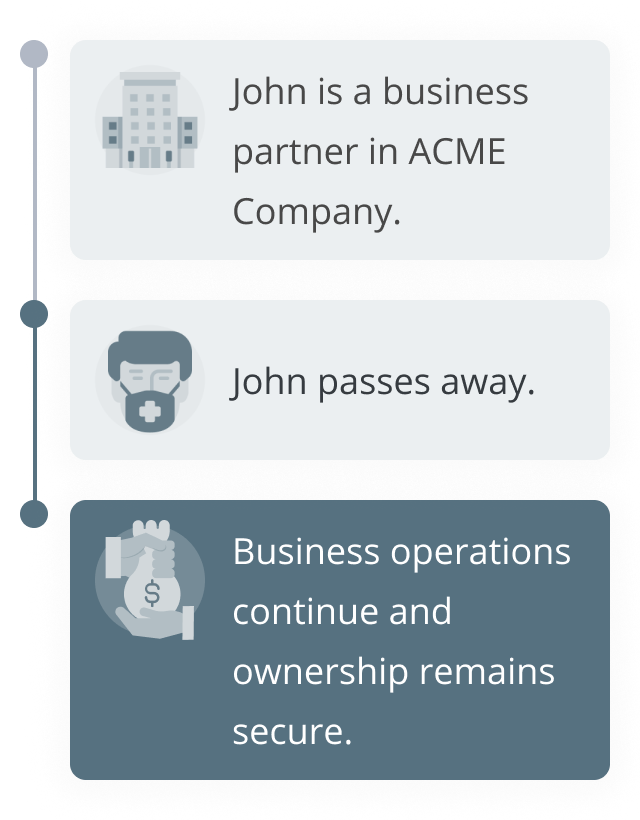

Should the unthinkable happen to John, ACME would receive an insurance payout to ensure a seamless transition and to buy out the departing partner's shares–maintaining continuity and stability.

Should the unthinkable happen to John, ACME would receive an insurance payout to ensure a seamless transition and to buy out the departing partner's shares–maintaining continuity and stability.

Partnership Insurance ensures your business remains stable in the unfortunate event of the death or critical illness of a partner.

Business continuity

In the event of a partner’s death or critical illness, your company receives an insurance payout that allows the remaining partners to buy out the departing partner’s share.

In the event of a partner’s death or critical illness, your company receives an insurance payout that allows the remaining partners to buy out the departing partner’s share.

Seamless transitions

Partnership Insurance facilitates a smooth transition, preserving your company’s stability, reputation, and relationships with clients and suppliers.

Partnership Insurance facilitates a smooth transition, preserving your company’s stability, reputation, and relationships with clients and suppliers.

Peace of mind

Partners can focus on growing the business rather than worry about financial repercussions from unforeseen events or partner-related issues.

Partners can focus on growing the business rather than worry about financial repercussions from unforeseen events or partner-related issues.

Common questions and answers

Typically, all partners in the business can be covered under the policy. It is essential to assess the key individuals whose absence would affect the company’s operations.

It is advisable to review the policy regularly, especially after significant business changes such as new partners joining, changes in business valuation or shifts in partnership structure.