Structured Deposit (Currency Linked Target Rate)

Enjoy principal protection1 and earn higher potential interest

Structured Deposit (Currency Linked Target Rate) is an unlisted structured investment product involving derivatives. Investment involves risks. The investment decision is yours but you should not invest in this product unless the intermediary who sells it to you has explained to you that the product is suitable for you having regard to your financial situation, investment experience and investment objectives.

Structured Deposit (Currency Linked Target Rate) is NOT protected deposit and is NOT protected by the Deposit Protection Scheme in Hong Kong. It is NOT equivalent to nor should it be treated as a substitute for a traditional fixed deposit.

100% principal protection1

Receive 100% of the principal amount upon deposit maturity regardless of currency movement1.

Receive 100% of the principal amount upon deposit maturity regardless of currency movement1.

Higher potential interest return

Enjoy a higher potential return than a normal time deposit depending on foreign currency price movement.

Enjoy a higher potential return than a normal time deposit depending on foreign currency price movement.

Choice of Bullish or Bearish view

Capture the foreign exchange movement by adopting a bullish or bearish strategy.

Capture the foreign exchange movement by adopting a bullish or bearish strategy.

No currency conversion

Get back your return in the currency of your deposit at maturity.

Get back your return in the currency of your deposit at maturity.

Flexible tenor and 10 currencies to choose from

Choose a tenor from 3 to 6 months, or up to 12 months to suit your financial needs.

Enjoy a wide selection of 10 currencies (HKD, USD, AUD, CAD, NZD, JPY, CHF, GBP, EUR and CNY)

Choose a tenor from 3 to 6 months, or up to 12 months to suit your financial needs.

Enjoy a wide selection of 10 currencies (HKD, USD, AUD, CAD, NZD, JPY, CHF, GBP, EUR and CNY)

No Extra Handling Charge2

Remarks

- Principal protection is only applicable if this product is held to maturity, subject to the credit and insolvency risks of the Bank and the Structured Deposit (Currency Linked target rate) Terms and Conditions.

- Subject to the Structured Deposit (Currency Linked target rate) Terms and Conditions.

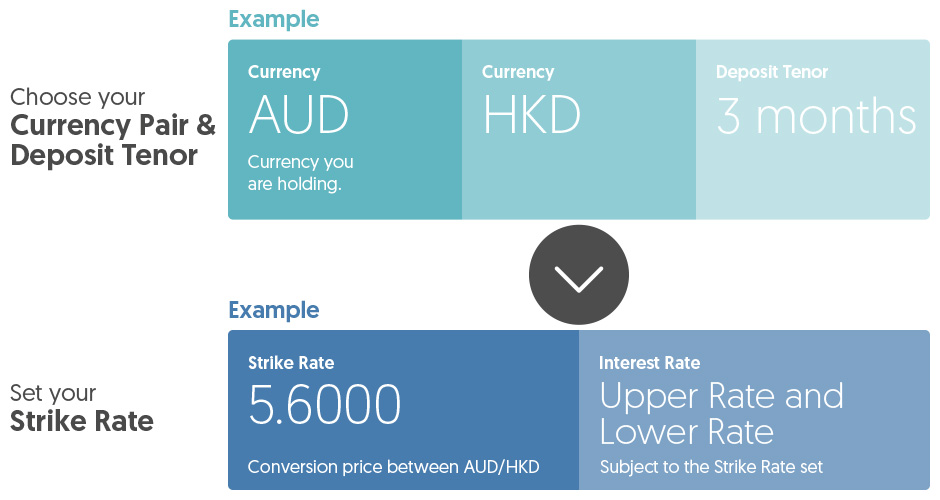

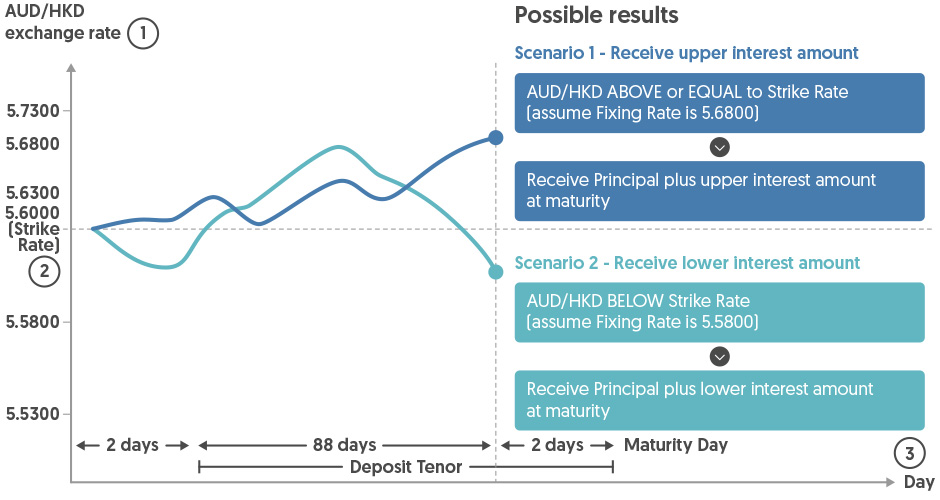

Assume you are holding AUD, and the current exchange rate of AUD/HKD is 5.5900. You take a bullish view on the AUD against the HKD and forecast AUD/HKD will be 5.6000 or above after 3 months.

1. Select

2. Possible exchange rate movement

1

Tips: You can select USD, CAD, NZD, JPY, CHF, GBP, EUR, CNY and more! Up to 10 currencies!

2

On the Exchange Rate Fixing Date (i.e 2 business days before the maturity date), compare the Strike Rate and the Fixing Rate (i.e. exchange rate of your currencies on Exchange Rate Fixing Date) to determine the amount of interest payable to you. You will receive 100% of the principal plus interest (either upper or lower) amount upon deposit maturity regardless of currency movement (note).

3

Tips: Customizable tenor from 3 months to 6 months in general with a maximum of 12 months, subject to your needs!

*Note: Principal protection is only applicable if this product is held to maturity, subject to the credit and insolvency risks of the Bank and the Structured Deposit (Currency Linked target rate) Terms and Conditions.

On the other hand, if you forecast AUD to depreciate in the future, you can set a lower Strike Rate. If AUD depreciates to equal or lower than the Strike Rate, you will receive the Principal Amount plus an upper interest amount at maturity. Otherwise, you will receive the Principal Amount plus a lower interest amount at maturity.

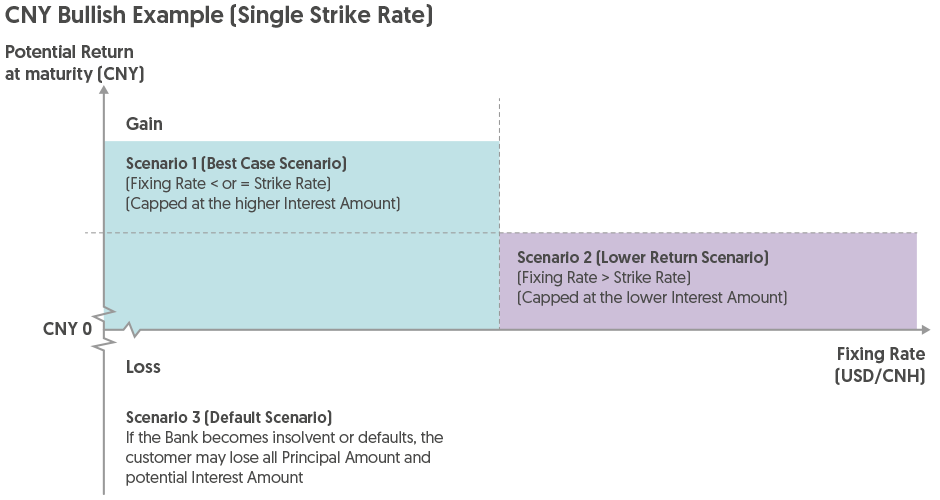

Single Strike Rate

This scenario analysis for Currency Linked Target Rate Deposit is based on the following terms (CNY Bullish view)

- Deposit Currency

| Deposit Currency | CNY |

| Principal Amount | CNY 100,000.00 |

| Deposit Tenor | 6 Months (180 days) |

| Currency Pair | USD/CNY |

| Initial Fixing Rate | 6.0972 (USD/CNH) |

| Strike Rate | 6.0362 (USD/CNH) |

| Fixing Rate | The exchange rate of the Currency Pair on the Exchange Rate Fixing Date |

|

Interest Rate

(1) Target Return Rate OR (2) Minimum / Lower Return Rate (it may be zero) |

If the Fixing Rate on the Exchange Rate Fixing Date is:

(1) at or below of the Strike Rate, 5.60% p.a. will be applied; OR otherwise (2) 1.00% p.a. will be applied |

| Deposit Currency |

| Principal Amount |

| Deposit Tenor |

| Currency Pair |

| Initial Fixing Rate |

| Strike Rate |

| Fixing Rate |

|

Interest Rate

(1) Target Return Rate OR (2) Minimum / Lower Return Rate (it may be zero) |

Scenario 1 (Best Case) – If the Fixing Rate is at or below the Strike Rate, you receive the principal plus the target return interest:

Assuming the Fixing Rate is AT or BELOW the Strike Rate on the Fixing Date, you will receive the Principal Amount and an Interest Amount in the Deposit Currency calculated at the Target Return Rate as follows:

- = Principal Amount + Interest Amount calculated at the Target Return Rate

- = CNY 100,000.00 + CNY 2,800.00

- = CNY 102,800.00

Interest Amount

- = CNY 100,000.00 × 5.60% ÷ 360 × 180

- = CNY 2,800.00

In this scenario, you have an actual gain of an Interest Amount of CNY 2,800.00, representing an actual rate of return of 2.80% (i.e. Interest Amount (CNY 2,800.00) ÷ Principal Amount (CNY 100,000.00) x 100%) (rounded to the nearest 4 decimal places). This is the maximum potential gain under Currency Linked Target Rate Deposit even if your view on the Fixing Rate is correct.

Scenario 2 (Lower Return) – If the Fixing Rate is above the Strike Rate, you’ll still receive the principal amount plus a lower return

Assuming the Fixing Rate is ABOVE the Strike Rate on the Fixing Date, you will receive the Principal Amount and an Interest Amount in the Deposit Currency calculated at the Minimum / Lower Return Rate as follows:

- = Principal Amount + Interest Amount calculated at the minimum / lower Interest Rate

- = CNY 100,000.00 + CNY 500.00

- = CNY 100,500.00

Interest Amount

- = CNY 100,000.00 × 1.00% ÷ 360 × 180

- = CNY 500.00

In this scenario, you have an actual gain of an Interest Amount of CNY 500.00, representing an actual rate of return of 0.50% (i.e. Interest Amount (CNY 500.00) ÷ Principal Amount (CNY 100,000.00) x 100%) (rounded to the nearest 4 decimal places).

Scenario 3 (Default Scenario) – The Bank defaults in payment or becomes insolvent

Assuming that the Bank becomes insolvent or defaults on its obligations under this product, you can only claim as an unsecured creditor of the Bank regardless of the terms of this product. You may get nothing back and may lose all of your Principal Amount of CNY 100,000.00 and the potential Interest Amount even if your view on the movement of exchanges is correct.

Scenario Summary and Potential Return Analysis

- Deposit Currency

| Scenario | Fixing Rate (USD/CNH) | Total payout on the maturity date | Investment return at maturity (CNY) | Gain or loss against the Principal Amount (Actual %) |

| 1 | 6.0300 | CNY 102,800.00 | CNY 2,800.00 | 2.80% |

| 2 | 6.0400 | CNY 100,500.00 | CNY 500.00 | 0.50% |

| 3 | You will be ranked as an unsecured creditor against the Bank if the Bank becomes insolvent or defaults on its obligations under this product and you may lose the entire Principal Amount of CNY 100,000.00 and the potential Interest Amount. | |||

| Scenario |

| 1 |

| 2 |

| 3 |

Scenario 4 – If your home currency is not CNY

This scenario is based on the assumption that you convert USD16,393.44 (Principal Amount in Home Currency) to CNY100,000 at the Exchange Rate of 6.1000 (USD/CNH) and invest the Principal Amount CNY100,000 in this product.

Gain Scenario

Assuming that the Fixing Rate is AT or BELOW the Strike Rate on the Fixing Date, as elaborated under scenario 1 above, you will receive in cash the Principal Amount together with the Interest Amount (i.e. CNY100,000.00 + CNY2,800.00 = CNY102,800.00) payable in CNY on the Maturity Date. If you convert the CNY payments you receive back to USD, the amount you receive will be affected by the prevailing exchange rate between USD and CNY and you will make a gain only if the prevailing exchange rate is below 6.2708 (USD/CNH).

Assuming that the prevailing exchange rate between USD and CNY is 6.0390 (USD/CNH), you will receive USD17,022.69 (CNY102,800.00 / 6.0390). In this example, you will have an actual gain of USD629.25 (USD17,022.69 - USD16,393.44) or 3.84% (USD629.25 / USD16,393.44).

Break Even Scenario

Assuming that the Fixing Rate is ABOVE Strike Rate as elaborated in scenario 2 above, you will receive in cash the Principal Amount together with the Interest Amount (i.e. CNY100,000.00 + CNY500.00 = CNY100,500.00) payable in CNY on the Maturity Date. If you convert the CNY payments you receive back to USD, the amount you receive will be affected by the prevailing exchange rate between USD and CNY.

Assuming that the prevailing exchange rate between USD and CNY is 6.1305 (USD/CNH), you will receive USD16,393.44 (CNY100,500.00 / 6.1305) which is equal to your initial investment amount in your home currency.

Losing Scenario

Assuming that the Fixing Rate is ABOVE Strike Rate as elaborated in scenario 2 above, you will receive in cash the Principal Amount together with the Interest Amount (i.e. CNY100,000.00 + CNY500.00 = CNY100,500.00) payable in CNY on the Maturity Date. If you convert the CNY payments you receive back to USD, the amount you receive will be affected by the prevailing exchange rate between USD and CNY and you will suffer a loss once the prevailing exchange rate is above 6.1305 (USD/CNH).

Assuming that the prevailing exchange rate between USD and CNY is 6.1613 (USD/CNH), you will receive USD16,311.49 (CNY100,500.00 / 6.1613). In this example, you will have an actual loss of USD81.95 (USD16,311.49 – USD16,393.44) or 0.50% (USD81.95 / USD16,393.44).

In the worst case whereby CNY depreciates to zero, you may lose all of your investment.

Declaration

The illustrative examples above are hypothetical and provided for illustration purpose only. They do not reflect a complete analysis nor all possible factors of all possible potential gain or loss scenarios, are not based on the past performance of the exchange rates of the Currency Pair and must not be relied on as an indication of the actual performance of the exchange rate of the Currency Pair or this product. You should not rely on these examples when making an investment decision. The scenarios assume no fees and charges.

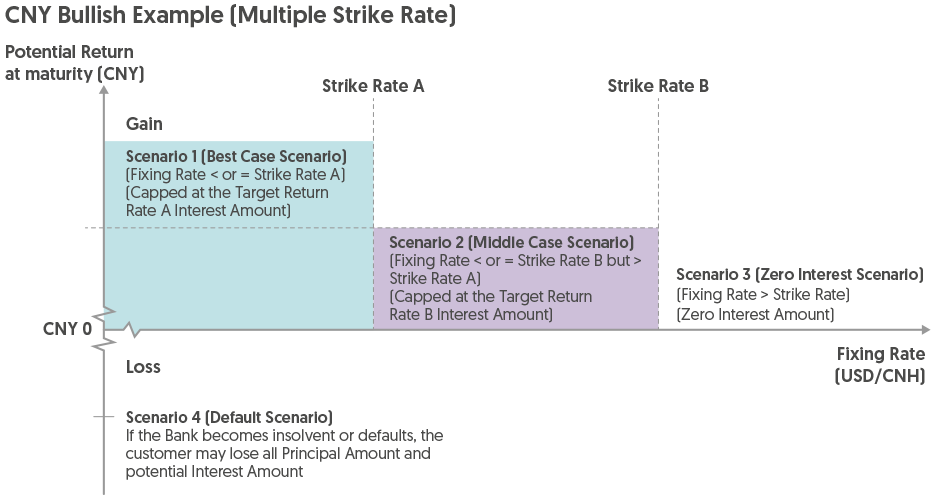

Multiple Strike Rate

This scenario analysis for Currency Linked Target Rate Deposit is based on the following terms (CNY Bullish view)

- Deposit Currency

| Deposit Currency | CNY |

| Principal Amount | CNY 100,000.00 |

| Deposit Tenor | 6 Months (180 days) |

| Currency Pair | USD/CNY |

| Initial Fixing Rate | 6.1000 (USD/CNH) |

| Strike Rate (A) | 6.0390 (USD/CNH) |

| Strike Rate (B) | 6.2000 (USD/CNH) |

| Fixing Rate | The exchange rate of the Currency Pair on the Exchange Rate Fixing Date |

|

Interest Rate

(1) Target Return Rate (A) OR (2) Target Return Rate (B) OR (3) Minimum / Lower Return Rate (it may be zero) |

If the Fixing Rate on the Exchange Rate Fixing Date is:

(1) at or below of the Strike Rate (A), 8.00% p.a. will be applied; OR (2) at or below of the Strike Rate (B) but above Strike Rate (A), 3.00% p.a. will be applied; OR otherwise (3) 0.00% p.a. will be applied |

| Deposit Currency |

| Principal Amount |

| Deposit Tenor |

| Currency Pair |

| Initial Fixing Rate |

| Strike Rate (A) |

| Strike Rate (B) |

| Fixing Rate |

|

Interest Rate

(1) Target Return Rate (A) OR (2) Target Return Rate (B) OR (3) Minimum / Lower Return Rate (it may be zero) |

Scenario 1 (Best Case Scenario) – The Fixing Rate is AT or BELOW the Strike Rate (A)

Assuming the Fixing Rate is AT or BELOW the Strike Rate (A) on the Fixing Date, you will receive the Principal Amount and an Interest Amount in the Deposit Currency calculated at the Target Return Rate (A) as follows:

- = Principal Amount + Interest Amount calculated at the Target Return Rate (A)

- = CNY 100,000.00 + CNY 4,000.00

- = CNY 104,000.00

Interest Amount

- = CNY 100,000.00 × 8.00% ÷ 360 × 180

- = CNY 4,000.00

In this scenario, you have an actual gain of an Interest Amount of CNY 4,000.00, representing an actual rate of return of 4.00% (i.e. Interest Amount (CNY 4,000.00) ÷ Principal Amount (CNY 100,000.00) x 100%) (rounded to the nearest 4 decimal places). This is the maximum potential gain under Currency Linked Target Rate Deposit even if your view on the Fixing Rate is correct.

Scenario 2 (Middle Case Scenario) – The Fixing Rate is AT or BELOW the Strike Rate (B) but ABOVE Strike Rate (A)

Assuming the Fixing Rate is AT or BELOW the Strike Rate (B) but ABOVE Strike Rate (A) on the Fixing Date, you will receive the Principal Amount and an Interest Amount in the Deposit Currency calculated at the Target Return Rate (B) as follows:

- = Principal Amount + Interest Amount calculated at the Target Return Rate (B)

- = CNY 100,000.00 + CNY 1,500.00

- = CNY 101,500.00

Interest Amount

- = CNY 100,000.00 × 3.00% ÷ 360 × 180

- = CNY 1,500.00

In this scenario, you have an actual gain of an Interest Amount of CNY 1,500.00, representing an actual rate of return of 1.50% (i.e. Interest Amount (CNY 1,500.00) ÷ Principal Amount (CNY 100,000.00) x 100%) (rounded to the nearest 4 decimal places). This is the potential gain under Currency Linked Target Rate Deposit even if your view on the Fixing Rate is correct.

Scenario 3 (Zero Return Scenario) – The Fixing Rate is ABOVE the Strike Rate (B)

Assuming the Fixing Rate is ABOVE the Strike Rate (B) on the Fixing Date, you will receive the Principal Amount and an Interest Amount in the Deposit Currency calculated at the Minimum / Lower Return Rate (i.e. zero) as follows:

- = Principal Amount + Interest Amount calculated at the minimum / lower Interest Rate

- = CNY 100,000.00 + CNY 0.00

- = CNY 100,000.00

Interest Amount

- = CNY 100,000.00 × 0.00% ÷ 360 × 180

- = CNY 0.00

In this scenario, you can only get back the Principal Amount.

Scenario 4 (Default Scenario) – The Bank defaults in payment or becomes insolvent

Assuming that the Bank becomes insolvent or defaults on its obligations under this product, you can only claim as an unsecured creditor of the Bank regardless of the terms of this product. You may get nothing back and may lose all of your Principal Amount of CNY 100,000.00 and the potential Interest Amount even if your view on the movement of exchange rates is correct.

Scenario Summary and Potential Return Analysis

- Deposit Currency

| Scenario | Fixing Rate (USD/CNH) | Total payout on the maturity date | Investment return at maturity (CNY) | Gain or loss against the Principal Amount (Actual %) |

| 1 | 6.0300 | CNY 104,000.00 | CNY 4,000.00 | 4.00% |

| 2 | 6.0600 | CNY 101,500.00 | CNY 1,500.00 | 1.50% |

| 3 | 6.2100 | CNY 100,000.00 | CNY 0.0 | 0.00% |

| 4 | You will be ranked as an unsecured creditor against the Bank if the Bank becomes insolvent or defaults on its obligations under this product and you may lose the entire Principal Amount of CNY 100,000.00 and the potential Interest Amount. | |||

| Scenario |

| 1 |

| 2 |

| 3 |

| 4 |

Scenario 5 – If your home currency is not CNY

This scenario is based on the assumption that you convert USD16,393.44 (Principal Amount in Home Currency) to CNY100,000 at the Exchange Rate of 6.1000 (USD/CNH) and invest the Principal Amount CNY100,000 in this product.

Gain Scenario

Assuming that the Fixing Rate is AT or BELOW the Strike Rate (A) on the Fixing Date, as elaborated under scenario 1 above, you will receive in cash the Principal Amount together with the Interest Amount (i.e. CNY100,000.00 + CNY4,000.00 = CNY104,000.00) payable in CNY on the Maturity Date. If you convert the CNY payments you receive back to USD, the amount you receive will be affected by the prevailing exchange rate between USD and CNY and you will make a gain only if the prevailing exchange rate is below 6.3440 (USD/CNH). Assuming that the prevailing exchange rate between USD and CNY is 6.0390 (USD/CNH), you will receive USD17,221.39 (CNY104,000.00 / 6.0390). In this example, you will have an actual gain of USD827.95 (USD17,221.39 - USD16,393.44) or 5.05% (USD827.95 / USD16,393.44).

Break Even Scenario

Assuming that the Fixing Rate is AT or BELOW Strike Rate (B) but ABOVE Strike Rate(A), as elaborated in scenario 2 above, you will receive in cash the Principal Amount together with the Interest Amount (i.e. CNY100,000.00 + CNY1,500.00 = CNY101,500.00) payable in CNY on the Maturity Date. If you convert the CNY payments you receive back to USD, the amount you receive will be affected by the prevailing exchange rate between USD and CNY.

Assuming that the prevailing exchange rate between USD and CNY is 6.1915 (USD/CNH), you will receive USD16,393.44 (CNY101,500.00 / 6.1915) which is equal to your initial investment amount in your home currency.

Losing Scenario

Assuming that the Fixing Rate is ABOVE Strike Rate (B), as elaborated in scenario 3 above, you will receive in cash the Principal Amount together with the Interest Amount (i.e. CNY100,000.00 + CNY0.00 = CNY100,000.00) payable in CNY on the Maturity Date. If you convert the CNY payments you receive back to USD, the amount you receive will be affected by the prevailing exchange rate between USD and CNY and you will suffer a loss once the prevailing exchange rate is above 6.1000 (USD/CNH).

Assuming that the prevailing exchange rate between USD and CNY is 6.2100 (USD/CNH), you will receive USD16,103.06 (CNY100,000.00 / 6.2100). In this example, you will have an actual loss of USD290.38 (USD16,103.06 – USD16,393.44) or 1.77% (USD290.38 / USD16,393.44).

In the worst case whereby CNY depreciates to zero, you may lose all of your investment.

Declaration

The above hypothetical examples are for illustrative purposes only. They do not reflect a complete analysis or all possible factors of all possible potential gain or loss scenarios. They are not based on the past performance of the exchange rates of the switched currency and must not be relied on as an indication of the actual performance of the exchange rate of the switched currency or this product. The Bank is not making any prediction on future movements of the exchange rates on the switched currency by virtue of providing the illustrative examples. You should not rely on these examples when making an investment decision. The scenarios assume no fees and charges incurred. In addition, all calculation results above are rounded off to two decimal places except for the exchange rates, which are rounded off to six decimal places.

Invest in Structured Deposit (Currency Linked Target Rate) today

Alternatively, you can contact us at (852) 3199 9188.

Important Notice and Risk Disclosure